BDSwiss is a trustable broker with a great reputation for years now for its operation and quality trading conditions, also with a good technical trading offering.

- Worldwide coverage through entities in Mauritius, Seychelles

- Wide Forex and CFD instruments

- Nunc consectetur urna quis elit

- Choice between MT4, MT5, Mobile App and Proprietary platform

- Fast account opening

- Suitable for Beginners and Professionals

- Quality customer support

- Support not available 24/7

- Operating via International Entities

- High Trading Spreads

- Low account type options

- Not suitable for traders outside of EU

Why to choose BDSwiss?

Here is why to choose BDSwiss or simply skip it, up to you to pick!

BDSwiss is an international brokerage firm whose current client base is more than 1.5 million registered clients from over 186 countries, as well as serving exclusive Member club with more than 1.5 million traders. Found in 2012, it quickly approached Markets and became one of the largest trading groups, and is now one of its leaders.

Since the approach of the company establishment comes from Switzerland, it has a strong basis in the environment, also providing online trading services as a worldwide operating group with established offices in different countries Tirana – Albania, Kuala Lumpur – Malaysia, Pristina – Kosovo. More details are provided in our BDSwiss Review and summary.

Advantages and Disadvantages

BDSwiss has a good reputation with a long history of operation, which is a plus, and user-friendly trading conditions, the account opening is fast and customer service is great quality, there is a great choice between trading platforms, with education and research tools covering anyone from beginners to those with advance trading knowledge.

We also noticed BDSwiss trading proposal depends on the entity, and instruments are limited to Forex and CFDs, so is worth reconsidering in case the proposal is suitable for you, Broker operates via its International entities only.

Overall BDSwiss Ranking

Based on our review and Expert Opinion in Forex Trading, BDSwiss is a trustable broker with a great reputation for years now for its operation and quality trading conditions, also with a good technical trading offering. That being said there are some gaps due to operation via International branches only.

BDSwiss Overall Ranking is 9 out of 10 based on our testing and compared to 500 other brokers, see Our Ranking below compared to other popular and industry Leading Brokers.

Is BDSwiss safe or a scam?

BDSwiss is a broker with many years of experience and a solid reputation; it is not a scam.

Is BDSwiss a regulated broker?

They are registered by the Mauritius Financial Services Commission (FSC) and ultimately increase the broker’s ability to provide its services to different clients around the world. We always recommend that you check on the regulation carefully and never sign in with non-regulated brokers (read more about why to avoid non-regulated brokers).

Ways you are protected

The Broker claims that the security of funds and client protection is provided in a variety of ways that guarantee a secure trading environment and investors’ legal compliance, including segregation of funds and participation in select customer protection organizations. However, if it is appropriate for you individually, we also encourage you to double-check the security layers.

What Leverage does BDSwiss offer?

Leverage, also known as a loan by the broker to the trader, allows you to trade with a multiplied volume that may increase your potential gains but also comes with higher risks. So, in addition to learning how to utilize tools wisely, you need also be aware of the regulatory requirements and restrictions which allow a safe level of leverage.

BDSwiss gives traders the choice to use higher leverage, allowing them to obtain a significantly greater exposure with comparatively less capital. Under FSA and FSC regulations, BDSwiss clients can trade with a maximum leverage of 1:1000.

However, to get the most accurate information, check the official BDSwiss platform and compare its allowance with your residual status. Also, check each instrument separately because it differs depending on the asset, in addition to using precisely reasonable levels to keep your risks low, see examples below.

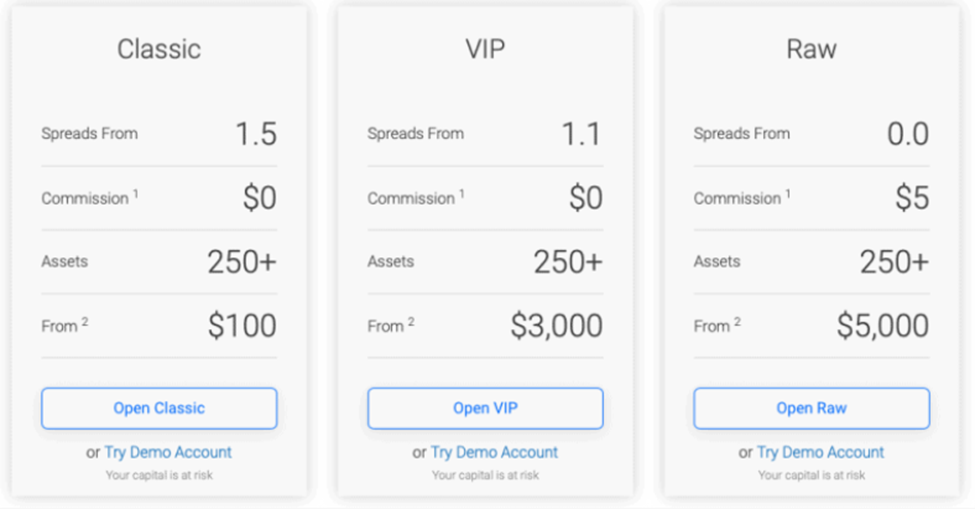

BDSwiss Account types

BDSwiss offers three account types: Classic, Vip, and Raw, that can meet the needs of different Forex traders with either lower costs according to trading sizes or advanced services once size increases. While Classic and Vip accounts are based on the spread-only model, Raw account features interbank spreads and commission charges per lot, which gives good flexibility to choose the account you would need the most, see the account comparison snapshot below.

Under its FSC regulated entity BDS Markets, BDSwiss also offers Premium account.

Also, we found one more account – StockPlus Account, available only under the FSC entity. BDSwiss’ StockPlus account enables BDSwiss clients to build a diversified portfolio with over 1000+ world-leading stocks and ETFs. The account features 0% commissions for unleveraged investing in stocks and the option to use up to 1:5 leverage to trade stocks and ETFs at DMA.

When opening your trading account there is an option to choose the desired base currency through the selection between the Euro (€), US Dollar ($), and the British Pound (£), which is fantastic because it implies that you won’t be charged for currency conversion, while the account balance can’t fall below zero due to the applied negative balance protection.

Fees

BDSwiss trading fees are mainly based on spreads, for each underlying asset you will be charged for we will find the usually applicable spread, while the rollover for short and long positions is also an additional charge if you held positions overnight, as well as the margin requirement. Full BDSwiss pricing including funding fees and Administration fees for non-use accounts, see the table below on our finds.

BDSwiss Fees are ranked average, low with an overall rating of 8 out of 10 based on our testing and compared to over 500 other brokers. Fees might be different based on entity, also the majority of currency pairs are on an average level for spreads, and additional fees like funding fees, rollover.

BDSwiss Spreads

BDSwiss Classic and VIP account fees are all included in the spreads and commissions charged when conducting trade and vary according to the account type you choose. If you are a larger-scale trader and prefer a commission basis then Raw Account is your choice. The Raw account offers an interbank spread averaging 0.3 for EURUSD and commission paid per transaction opening which is 5$. Check out the comparison of the most popular suitable assets below to get a deeper look into the BDSwiss Classic Account type, while the broker himself states that Classis spreads are starting from 1.5 pips, and VIP features lower conditions with a spread from 1.1 pip. Also, you may compare BDSwiss fees to the other brokers listed below.

BDSwiss Spreads are ranked average with an overall rating of 8 out of 10 based on our testing comparison to other brokers. We found Forex spread on industry average for standard accounts, and conditions might be better for commission-based accounts, compared to other brokers in the industry.

Trading Instruments

BDSwiss provides access to trade an extensive range of 1000+ assets, while you may choose from Indices, Forex, Commodities, and Cryptocurrencies based on CFDs, or Options Trading. However, the range of instruments depends on the account type or BDSwiss entity you use.

Therefore, with access to the most liquid and popular markets, you may choose the desired and most understanding instrument according to your trading need and use the BDSwiss portal to make this choice, which we should admit as user-friendly.

BDSwiss Instrument Selection Score is 8 out 0f 10 for good trading instrument selection, yet the selection of instrument might be different based on the platform you use or the entity of BDSwiss you sign up with.

Funding Methods

BDSwiss collaborates with numerous payment service providers that offer a number of deposit options in a particular country.

BDSwiss clients can choose their preferred deposit method right before funding trading accounts and enjoy $0 fees on all deposits. BDSwiss accepts introductory deposits, and processes withdrawals, in the form of instant transfers, bank transfers, or credit card transactions, but take note – outgoing credit card payments typically take between 2-7 business days to process.

BDSwiss Deposits and Withdrawals we ranked Excellent with an overall rating of 10 out of 10. The minimum deposit is low, also Fee conditions are good either with no fees or very small based on the funding method you use, besides a range of methods is very wide.

Trading Platforms

The BDSwiss software solution is a pillar of the widely used MetaTrader4 platform, which offers a comprehensive trading feature and a wide range of solutions. MT4 is a well-known and user-friendly platform in the industry, and despite having a few slightly obsolete layouts, it is still in use.

Additionally, traders will undoubtedly like the many add-ons that are offered on the market to make the trading experience enjoyable, as we did. Furthermore, since the broker does not impose strict restrictions, there are many other techniques to pick from, including news trading.

Because there are platform versions for different devices, traders can utilize any device, which is a positive thing. PC, Mac, applications, and Web platforms with no installation requirements fall under this category. Below are some of our findings regarding the positives and drawbacks of the platform.

With an overall rating of 10 out of 10, BDSwiss Platform is rated Excellent when compared to more than 500 other brokers. With a good selection of platforms, including the well-known MT4 and MT5, as well as its own platform developed with excellent research and tools, the high ranking is well-deserved.

Web Trading

Because proprietary BDSwiss WebTrader is entirely web-based, you may access trading directly from your browser without needing to download or install anything. The platform includes a clear interface and quite a few powerful analysis tools, such as those for technical analysis and risk management. As you can see from the trading snapshot below, you can profit from trading even when using WebTrader.

Desktop Platform

The versions of MetaTrader4 and MetaTrader5 that are readily available are compatible with a variety of devices, including PCs, Macs, applications, and web platforms that don’t require installations. However, if you like, you can download the desktop version for those platforms and utilize all of its features, which is more important for professional or active traders.

Because it is a more recent version, MT5, which is favored by both novices and experts, offers even more advanced capabilities and thorough analysis options. Additionally, there are a variety of techniques available that may be used by any trader, regardless of experience level, whether they like to trade manually or automatically using expert advisors (EAs).

Mobile Trading Platform

Naturally, BDSwiss also created a mobile app, that is extremely popular by traders and publications. There are all of the key elements present, allowing you to perform analysis while on the go, keep track of open positions, manage them, and access your account management—all of which are commendable in our book.

BDSwiss Customer Support

Customer support is another excellent feature that ought to be mentioned. With the daily services that traders need, BDSwiss offers bilingual support that is also quite dependable and competent. Even though you may Live Chat with them, call them, or email them during business hours, 7 days a week, we are still pleased with the level of quality.

Based on our testing, BDSwiss’s customer support is rated Good, with an overall score of 8 out of 10. Support is competent, offers quick responses on Live Chat, and is accessible during business hours.

Education

Through its Trading Academy, BDSwiss additionally educates its clients while providing the highest level of support and assistance.

We found the educational resources to be pretty handy and very well arranged, making them perfect for novices.

They contain important information on how to function in markets and construct one’s own trading strategy with approved courses and webinars

In BDSwiss you will find instructional resources given by Forex Courses, defined by the level of experience, Webinars, and Seminars.

There are excellent Daily Webinars offered, which is a terrific choice for all traders (particularly for novices to develop their Forex knowledge.) Through the Research & Analysis Section, you will also have access to important information, like market alerts, trading information, and analysis, which is unquestionably beneficial and essential for every trader, particularly newbies.

The company also maintains a thriving blog and trading community where members can share information and expertise in order to learn more about markets and trading in general.

By maintaining optimum support and assistance, BDSwiss also educates its clients through its Trading Academy. Educational resources covering useful information on how to operate in markets, develop own trading strategy with accredited courses and webinars, we found it quite hahndy and very well organized making them suitable for beginners.

BDSwiss Review Conclusion

An overall BDSwiss review concludes us a company that managed to increase client portfolio to over a million customers. There are stable trading conditions, proven along time, also what we saw along the history of BDSwwiss development, with a global proposal suited to worldwide clients, the range of accounts and education provided is good, research we would rank as outstanding, which is super big plus for any trader.

So BDSwiss might be a good match to various size traders, yet would be good to check all trading conditions and regulations and define if it is suitable for you, since for now BDSwiss operates only via International entities. Here you can also read our article about Islamic forex brokers.

Vestibulum vehicula dapibus leo, ut fermentum dolor sollicitudin at. Sed euismod lobortis ipsum sit amet pharetra.

Donec lacinia erat in ullamcorper accumsan.

Fusce fringilla efficitur varius. Integer elit turpis, tristique non massa ac, vehicula viverra urna. Maecenas congue pulvinar mattis.