Night Life Crypto price is unchanged in the past week. The current price is $0.26 per NLIFE. The new price represents a new all time high of $0.26.

MicroStrategy was largely unknown outside of big tech and conventional finance before it became one of the biggest Bitcoin bulls in the world. When the Fortune 500 company added Bitcoin holdings on its balance sheet in 2020, that situation altered.

One of the major companies in the bitcoin business and the broader blockchain industry is MicroStrategy. They were among the first businesses, under the direction of chairman Michael Saylor, to think of BTC as a store of value. This paved the way for other well-known businesses to buy Bitcoin, including Tesla.

We are aware that MicroStrategy is a fervent proponent of digital currency, but who is the organisation responsible for its online notoriety? Do they own any other digital assets, such as NFTs or Ethereum?

Describe MicroStrategy.

MicroStrategy is a software provider that offers strong analytics and business intelligence solutions. It was established in 1989 by Michael Saylor. Some of the biggest businesses and household names in the world, including Visa and Porsche, use MicroStrategy solutions.

Naturally, creating data dashboards can only advance a business so far. Cloud computing services are one of MicroStrategy’s expanding offerings.

But is there a connection between Bitcoin and MicroStrategy?

Market MicroStrategy for Cryptocurrencies

MicroStrategy owns more Bitcoin than any other publicly traded corporation, including some of the biggest exchanges like Coinbase, according to Coingecko (as of February 2023). MicroStrategy views Bitcoin as a long-term investment and is unconcerned by things like the FTX meltdown and the cryptocurrency bear markets.

First-Time Bitcoin Purchase

Midway through 2020, MicroStrategy initially revealed interest in Bitcoin as an inflation hedge. Following the pandemic’s negative economic effects, the value of the United States Dollar (USD) was fast declining.

Saylor stated that “it makes sense to put our treasury assets into certain investments that can’t be inflated away” in a June earnings call with the company’s CFO, Phong Le. By August 2020, MicroStrategy declared they had purchased 21,454 BTC for a price of more than $250M. At that moment, BTC was worth about $11,000.

Since then, despite the volatility in the cryptocurrency market, MicroStrategy has consistently increased its bitcoin holdings. The IT giant is now buying Bitcoin for an average cost of around $30,415 per BTC as of February 2023.

A bitcoin sale by MicroStrategy ever occurred?

Following a difficult year for Bitcoin, mainstream media and cryptocurrency news sites quickly spread the breaking news that MicroStrategy has sold. After the crypto winter of the previous year, it appeared that Saylor and Co. needed to reduce their losses.

Contrary to what the headlines implied, MicroStrategy stated in a filing with the SEC that they intended “to carry back the capital losses resulting from this transaction against earlier capital gains… which may yield a tax benefit.”

Although this might have temporarily caused panic and scepticism in the cryptocurrency market, MicroStrategy has now bought back bitcoin. The business is more committed than ever to digital money. MicroStrategy intends to sell its other assets to raise money for additional BTC investments, according to a filing with the Securities and Exchange Commission.

What Is the Liquidation Price for MicroStrategy?

According to Binance, Silvergate loans helped to partially finance MicroStrategy’s Bitcoin investment. MacroStrategy, a division of the tech company, also holds a leveraged stake in bitcoin.

MacroStrategy would need to increase the collateral on its position in the event of a big crash in order to maintain its position. A unpleasant margin call would be issued to Macrostrategy if the price of bitcoin fell to $13,644.

Other Crypto Assets Held by MicroStrategy

Once compelled to sell, when will MicroStrategy do so? I certainly hope not anytime soon. BTC held by MicroStrategy faces liquidation at a considerably lower price of approximately $3,561.

MicroStrategy does not officially hold any other cryptocurrencies, despite unquestionably being optimistic on bitcoin and blockchain technologies. The MicroStrategy balance sheet does not include other currencies like ETH.

The downsides of being a bitcoin maximalist are real. Ironically, MicroStrategy would have made more money if they had purchased Ethereum rather than Bitcoin. MicroStrategy would own 3,540,000 ETH if it bought ETH instead of BTC.

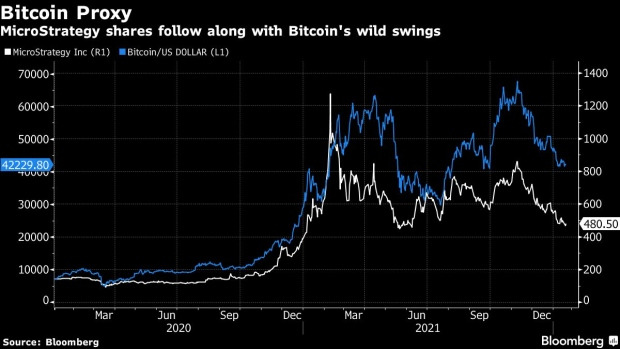

Investors’ reactions to the addition of Bitcoin to the company’s balance sheet for MicroStrategy (MSTR) have been conflicting. The company’s treasury has been exposed to more volatility as a result of holding BTC, which coincides with the performance of the MSTR stock.

Market MicroStrategy for Stocks

Following MicroStrategy’s BTC acquisitions in December 2022, according to Bloomberg, the price of MSTR stock fell to its lowest level since 2020. It’s crucial to remember that MicroStrategy had lost over a billion dollars through its Bitcoin investments at that time.

What Position Does MicroStrategy’s Michael Saylor Hold?

Co-founder and CEO of MicroStrategy Michael Saylor resigned in August 2021. Saylor’s new position as executive chairman does not diminish his ongoing involvement with the business. Saylor now has more freedom to pursue MicroStrategy’s Bitcoin strategy as a result of the change.

Phong Le, a former CFO and President, took up Saylor’s role as CEO.

On the other hand

- Even if some people might think MicroStrategy’s liquidation point is unachievable, it would undoubtedly cause a generalised panic in the cryptocurrency market. The price of Bitcoin and the standing of cryptocurrencies and blockchain may both suffer devastating blows if MicroStrategy were compelled to sell its BTC holdings.

Why It’s Important

Among corporate entities, MicroStrategy holds the most Bitcoin. Their faith in and support for Bitcoin (BTC) and the blockchain sector mark the entry of institutional money into the cryptocurrency world.

Due to this, Web 3.0 technologies and cryptocurrencies have a better reputation in the eyes of both traditional finance and the general public. The investment by MicroStrategy is a milestone in the direction of widespread use of bitcoin and blockchain technologies.

F.A.Q.S.

What percentage of Bitcoin does MicroStrategy hold?

MicroStrategy currently owns 129,699 bitcoins as of February 2023. Approximately 0.618% of the entire Bitcoin supply is represented by this. For the most recent readings of this statistic, please visit Coingecko’s dedicated page on public Bitcoin holdings.

Is MicroStrategy the biggest Bitcoin holder?

The enigmatic creator of Bitcoin, Satoshi Nakamoto, is the largest BTC holder. However, as of February 2023, MicroStrategy is the biggest corporate body and publicly traded firm holding BTC on its balance sheet.

Bitcoin: Did MicroStrategy Sell It?

The first time MicroStrategy sold bitcoin was in December 2022 when it sold 704 BTC. The sale was conducted in order to offset prior capital gains with capital losses. MicroStrategy has since repurchased BTC and continues to be bullish on bitcoin in the long run.

What Justifies MicroStrategy’s Large Bitcoin Holdings?

Bitcoin is an inflation hedge, according to Michael Saylor and Phong Le. With its Bitcoin investment, MicroStrategy wants to avoid having its assets depreciate due to inflation.

What Functioned MicroStrategy Prior to Bitcoin?

MicroStrategy was a software business that created advanced data tools before it purchased bitcoin. The company’s main line of business remains in this.

Will Bitcoin Be Forced Into MicroStrategy’s Hands?

If the spot price of Bitcoin drops to $3,561, a margin call is anticipated to be issued to MicroStrategy. Prior to that, MicroStrategy will have to provide more collateral to back up its claim or risk being forced to sell bitcoin.

How much bitcoin did MicroStrategy lose?

The typical buying price for MicroStrategy as of February is roughly $30,415 per bitcoin. This results in an unrealized loss on MicroStrategy’s bitcoin investment of about $1 billion as of the time of writing.