Markets.com offers services for both novice and experienced traders. It offers a competitive commission-free pricing environment, a proprietary trading platform alongside MT4 and MT5, and superior order execution metrics. It provides a highly regulated trading environment, with the broker being owned by the FTSE 250 member and UK publicly traded corporation Playtech PLC.

- Free and fast deposit and withdrawal

- Easy and fast account opening

- Great tools for learning and research

- High language coverage in customer support

- High forex fees

- Limited product portfolio

- Platforms lack some common features

Why to choose Markets.com?

Here is why to choose Markets.com or simply skip it, up to you to choose!

Global brokerage company Markets.com serves clients from all over the world.

It is one of the largest Forex and CFD providers offering more than 2,200 trading asset

The firm is regulated by some of the most stringent financial authorities, including the FCA of the UK and ASIC of Australia. Additionally, Markets.com provides exceptional customer service by offering assistance in a number of languages, including Arabic, French, German, and Italian. The support team is also accessible via email and live chat twenty-four hours a day, 5 days a week.

Markets.com is one of the best trading brokers available thanks to its simple account opening process, user-friendly platforms, and extensive selection of trading tools and instruments. Clients with all degrees of trading expertise can benefit from the broker’s offering because it includes educational resources and professional financial analysis.

On the flip side trading fees for Stock CFDs are higher, and there is no 24/7 support.

Is Markets.com safe or a scam

Markets.com is a reliable broker. The company is regulated by top-tier authorities such as the ASIC in Australia and the FCA in the UK.

Is Markets.com legitimate?

Markets.com is a global brand and trademark operated by Safecap Investment Ltd located in Cyprus (Nicosia) and a regulated investment services firm authorized in the conduct of activities by the Cyprus Securities and Exchange Commission (CySEC). Safecap Investments Limited is owned by Finalto Limited and is a subsidiary of Playtech PLC, a company traded on the London Stock Exchange’s Main Markets and a constituent of the FTSE 250 Index.

How are you protected?

Simply put, the broker takes compliance seriously if they are authorized by credible authorities. Also, Markets.com maintains high operational standards and provides safety to its clients by offering negative balance protection. For example, the broker validates capital ratio along with reporting, retains customer funds in segregated bank accounts at licensed institutions, and offers web security protection.

Leverage

Markets.com offers marginal trading, allowing you to trade with a larger portion of your original investment and manage greater positions. This tool gives you a significant edge by raising your potential gains, but you should understand leverage and be aware of the risks before utilizing it.

Most international brokers now provide lower amounts of leverage due to the updates in regulatory requirements, thus you should always verify condition according to your own residency and applicable laws of Markets.com entity.

yet with Markets.com you may still enjoy a high level of leverage of up to 300:1 for Forex major instruments.

Maximum leverage depends on the entity and regulation: 1:30 ASIC/FCA/CySEC1:300 BVI FSC

Account types

Markets.com offers one main account type and a demo account, created to perform at the highest level given your trading capabilities. Account opening is a straightforward procedure with a range of services that are determined by your level of expertise.

Instruments

Access to over 2,200 trading assets. including shares, indices, currencies, *cryptocurrencies, commodity CFDs with 0 commission and leverage ratios of up to 1:300 as we found through Markets.com review.

The trading instruments approachable by Markets.com platform include both regular offerings among brokers, and unique ones too. There are numerous advantages which you may enjoy through Shares dealing through Markets.com with over 12 major markets with zero commission.

Forex trading including major, minors and exotic currency pairs over 60 in total, while paying only spread with no commission, while on popular pairs EUR/USD, GBP/USD spread is around 0.7 pips.

*Crypto CFDs are not offered to retail clients in the UK

Crypto trading is also an option for a trader that uses this broker. On Markets.com you can trade 25 different crypto assets including Bitcoin, Ethereum and Ripple.

It is important to note that trading of Crypto CFDs is not offered to UK residents.

Moreover, Markets.com included Blends to their offerings, which are baskets of shares that are combined to reflect a shared theme as a single product which been chosen based on Market Capitalization, Trading Volume, Liquidity and Price Volatility.

Fees

The trading costs at Markets.com are all included into the floating spread if you trade via the Markets.com trading platform, which is very competitive when compared to the spreads of other brokers.

For share dealing you will be offered 0 commission for the first three months and afterwards you will be charged a low commission.

Spreads

For your information and better understanding, please refer to the Markets.com standard account spreads listed below. You may also compare Markets.com costs to those of other well-known brokers.

SWAP fees

If you hold opened position overnight or for a period longer than a day, you will be charged an overnight fee, which you should also consider to be a trading expense. For instance, the overnight fee for EUR/USD pair is set to a -2.05 in case you go short and -0.54 for long positions.

Deposit Options

The company accepts various payment options to place direct deposits, including Credit/Debit Card:

Visa, Mastercard, Wire transfers, fast wire transfers in local currency, as well using e-wallets PayPal, Skrill, Neteller and additional Sofort, Giropay, iDeal.

The minimum deposit for Markets.com is 100$, which allows beginners or traders of any size to open an account easily. However, make sure to examine the applicable conditions based on your residence and the proper account for you.

Withdrawals

Withdrawals are often completed swiftly and without fees, but certain banks may impose a transaction fee. The following applies to minimum withdrawal amounts and withdrawal periods:

Credit/Debit Card: Minimum – $10. Timeframe – 2 to 7 business days

Wire Transfer: Minimum – $100 & €20 within EU. Timeframe – 2 to 5 business daysSkrill/Neteller: Minimum – $5. Timeframe – Up to 24 hours

Trading Platforms

Markets.com has created a trading platform with a focus on its clients’ trading and investment needs. In particular, the Markets.com trading platform offers many benefits such as access to a wide range of fundamental, technical and sentiment-based trading tools as well as expert analysis. Additionally, traders have the choice of engaging in share dealing with the enormous selection of stocks available. In case you still prefer a reliable and common choice of MetaTrader, you have the option to trade through MT4 and MT5 along with comprehended trading capabilities enhanced by Markets.com powerful tools.

Web Platform

Markets.com relies on award-winning trading software that has been chosen by several traders and business leaders., Markets.com trading platform is available through Web and App versions.

The platform is easy to use and gives users access to a number of tools, giving them the benefit and capacity to create their own distinctive trading strategy.

Forex Provider of the Year | UK Forex Awards

Best Forex Trading Platform | UK Forex Awards

Best Trading Platform 2020 FX Scouts

Desktop Platform

The proprietary platform featuring interactive and responsive just through a few clicks user interface through shortlisted most favorite customizable charts, educational, in-depth analysis of beneficial materials.

The broker sponsors continuing, multi-level instructional webinars. Trading professionals can monitor developments and rationalize the trading process with the help of risk management tools like Stop Loss that have been incorporated.

Customer Support

Markets.com’s proposal promises specialized service and help with the information you need; we investigated these claims and discovered that its support is on par with its availability of relevant details.

You can contact customer service about your concerns over the phone or live chat, and staff are available 24/5.

Education

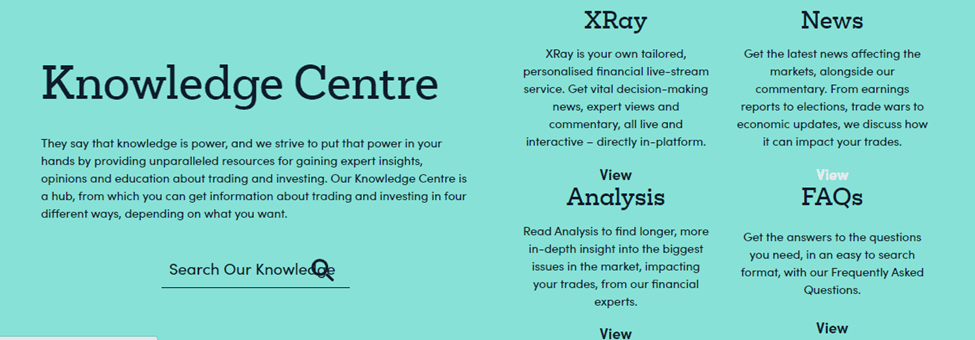

Every client has access to a wealth of educational resources through the Markets.com Trading Knowlegde Center, full of trading data and other essential information that raises trading to a higher level, in addition to receiving excellent customer support. In this aspect, Markets.com went above and beyond and created genuinely extensive education support across numerous locations with the intention of educating traders, which is fantastic for all traders.

Conclusion

In conclusion, The Markets.com is a licensed broker with a good reputation, solid track record, and appealing market strategies. It offers multiple assets to trade including Cryptocurrencies while One of the biggest company advantages is their proprietary platform, a reliable option for trading experience, as well powerful solution in terms of technical optimization. However, since the platform is hosted online or can be accessed by an application, there is no need for installation. Since the minimum initial investment required by the company is merely $100, new traders will feel at ease there as well. Here, the Markets.com general offer provides a compelling menu of options.