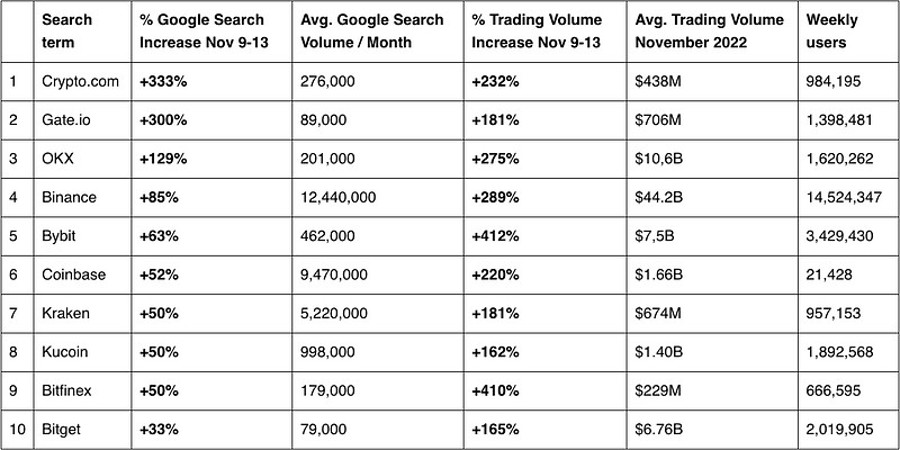

In accordance with the study’s findings, trade volume on Crypto.com increased by 232% and Google searches by an astounding 333% throughout the studied time. Gate.

Days following the FTX turbulence, Google searches for Crypto.com increased by 333%.

The biggest increases in trading volume were noted by Bybit and Bitfinex.

According to a new analysis by Trading Browers, a digital assets analytics tool, retail investors’ attention was mostly directed towards the Crypto.com and Gate.io platforms in the early days following the collapse of the FTX bitcoin exchange.

FTX Collapse Boosted Crypto.com and Gate.io Popularity

Trading In the early days following the collapse of the FTX ecosystem, between November 9 and November 13, 2022, Browers looked at which of the largest cryptocurrency exchanges had the greatest rise in Google Search and trading volumes.

The study’s findings indicate that throughout the studied time, Google searches for Crypto.com increased by an astounding 333% and trade volume increased by 232%. Gate.io also noticed an increase in total turnover (+181%) and search interest (+300%).

Contrarily, Bitfinex (+410%) and Bybit (+412%) had the largest increases in trading volumes over the course of the time, but their corresponding increases in search interest were significantly smaller, at 63% and 50%, respectively.

Continue reading

- Ceffu of Binance searches for a corporate cryptocurrency licence in Singapore

- What Draws Retail Brokers to CFDs So Much?

“The flexibility and agility of the cryptocurrency business are demonstrated by traders’ ability to swiftly switch their attention to other exchanges or safe wallets in reaction to market conditions. The results highlight the significance of keeping up with market trends and having the flexibility to quickly change strategies. They also provide insightful information about the state of the market and trader behaviour, giving investors the knowledge they need to make wise investment decisions “The Trading Browser spokesperson offered their opinion.

Traders Switch to More Secure Wallets After FTX Unrest

According to the survey, there has been an upsurge in search results for more secure crypto storage. On November 13, searches for the terms “Hardware Wallet,” “Trust Wallet,” and “Ledger Nano X” increased by 104% and 175%, respectively.

Data compiled by Glassnode, a supplier of on-chain analytics solutions, attests to this. Coins were moved into self-custody wallets by Bitcoin investors at the historically greatest pace of 106,000 BTC per month after the demise of FTX. There have only ever been three prior observations of such incidents.

Non-custodial wallets, as opposed to custodial ones, are those where a person uses their own keys and no other entity is involved. Non-custodial wallets may be divided into hot and cold categories, much as custodial wallets. Further information on recommended practises for crypto wallet security may be found here.