A global fintech company offers online trading services for futures, stock trading, contracts for difference, and options on futures. The business has affiliates in the United Kingdom, Cyprus, Australia, Israel, Seychelles, Singapore, Bulgaria, Estonia, the United States, and Japan.

- Easy-to-use platform

- Great account opening

- Quick and helpful customer support

- Well-regulated globally

- Broad asset selection in equities and options

- Mediocre research tools

- Average CFD fees

- Low leverage for retail traders

- Lack of trading tools

- No research and limited, below-average educational content

Why to choose Plus 500?

Here is why to choose Plus 500 or simply skip it, up to you to choose!

Israel-based Plus500 was established in 2008, and it currently has a global presence through Cyprus, the UK, Australia, Singapore, and other countries. Actually, Plus500 is a well-known CFD provider that has solidly built a foundation for its expert trading environments and future expansion.

The real size of the company is evident from the official number, as we discovered in the Plus500 Review, and it serves over 304+ thousand active clients. Plus500 is a listed, licensed financial CFD provider. Over 39+ million positions were opened in the past year alone, and over 1849 billion dollars worth of trading was done.

Trade on the go!

Plus500 is a well-known company with many traders all around the world. It is a credible broker with FCA, CySEC, and other regulations. For added transparency, it is also listed on the stock exchange. One of the top brokers for CFD trading is Plus500, which also offers a mobile app and an intuitive trading platform. The product offering is primarily based on CFDs, however, therefore the proposition may not be suitable for beginners in the absence of basic instruction or a competent research tool.

How does Plus500 trading work?

With support in 16 languages available around-the-clock and true global coverage of the enabled operation, Plus500 enables retail and professional accounts to trade CFDs on a variety of assets offered in more than 50 countries. Ultimately, Plus500 offers financial investment opportunities by opening up financial markets to traders around the world with its created trading technology based on CFDs.

Additionally, the company is a listed official CFD provider, which provides additional protection and benefits to its traders.

Additionally, Plus500 demonstrates an appreciation for the significance of innovation by continually enhancing its trading services and rewarding customers with favorable trading conditions.

In addition, a number of trading programs or add-ons were created to improve functionality; these award-winning programs were designed for large communities, affiliates, and traders.

Safe trading before everything else!

Due to its eligibility to provide Contracts for Difference (CFD) trading and a variety of underlying products through the implementation of the highest regulations, Plus500 is regarded as secure and not a scam. Meaning that the trading experiences and results provided by Plus500 are entirely legal and set in accordance with the safety regulations applied by well-known and reputable financial regulators.

In the end, registration in a widely respected jurisdiction gives you access to a state company that is continuously monitored and established to high standards, which in turn guarantees its sustainability. The reason we continually advocate for regulation is because there are many “alluring” trading brokers that were only founded through offshore, poorly regulated entities. These brokers may never provide you with a secure environment for trading because there are no regulations in place.

Is Plus500 authorized and regulated?

The Plus500 trademark is used to identify a regulated CFD platform run by Plus500 Ltd, which has permission from the relevant financial authorities. These include the United Kingdom Financial Conduct Authority, the Cyprus Securities and Exchange Commission, the Australian Securities Investment Commission ASIC CySEC FCA FSB and MAS in Monetary Authority of Singapore.

Additionally, Plus500 Ltd. has a strong financial history and is listed on the Main Market of the London Stock Exchange, contributing to the public’s faith in them. See the names of certain Plus500 entities and regulatory licenses below.

How are you protected?

Even though the laws for Plus500 operation will vary significantly depending on the jurisdiction and regulation, its top priorities are always the safety of investors and traders. Therefore, CFD provider strictly complies with a number of client protection tools in compliance with the CySEC, FCA, Australian Securities and Investment Commission, and other recognised regulations.

To ensure the safety of day traders, regulators are required to implement safety measures under any or all scenarios and to provide the maximum level of financial protection under various circumstances. The CFD provider utilizes its own funds for any hedging or other business-related activities because the client’s assets are always paid into a segregated trust account.

Additionally, all client accounts are protected by Negative balance protection, which ensures that clients cannot lose more money than is currently in their account. You can confirm additional information on the official website of the regulators.

Leverage

Regarding the risks associated with Plus500, which primarily focused on the strategy and leverage you apply, you should be aware that when trading, your capital is at risk and retail investor accounts can experience a loss.

However, the citizens of different countries are subject to particular jurisdiction rules due to regulatory restrictions and authorized operation requirements.

Since traders will encounter certain variances between the leverage levels offered owing to regulations, it is important to confirm and understand what level you are authorized to use before you begin. As professionals, you can access high leverage ones after proving your status, depending to your level of experience as well.

European CySEC, ASIC and FCA regulated traders will enjoy maximum leverage of 1:30

MAS traders are allowed to get a multiplication of Plus500 leverage up to 1:50

South African traders will be offered to use 1:20 for Shares, 1:300 for Forex and Indices, and 1:30 for Crypto assets.

What is required margin?

Each instrument defines its own margin to be traded, also is different according to the applicable leverage. For this information you should check directly from the platform specifically for the instrument you’re going to trade.

Account Types

Plus500 offers a standard trading account to all clients, so you may simply proceed with account activation along with a minimum deposit to convert your Demo account to a live one, since you can choose a free unlimited Demo account, which is easily opened and further can be converted to the real trading.

Who can open a Plus500 account?

Due to international branches almost all over the major jurisdictions, Plus500 accepts clients from many countries around the world. However, some regions will fall under restrictions, thus US, Canada, Indonesia, Cuba and Iran. So you always better check whether you falling under these rules or not.

Can a Plus500 account be opened by South African residents?

Yes, if you are South African resident you may trade under Plus500AU Pty Ltd which is an authorized South Africa Financial provider. If you are eligible to use Plus500 trading service, there is offer of Islamic Accounts a specified feature for those traders who require special conditions due to the follow of Sharia rules. Therefore, Islamic traders are most welcomed as well.

What are the account types?

To maintain simplicity, Plus500 offers a standard trading account to all clients, so you may simply proceed with account activation along with a minimum deposit to convert your Demo account to a live one.

Once done despite trading size or level of your experience all clients use one account feature, while further, traders may get some extra benefits and discounts as long as the trading size increases.

How to open an account?

Consequently, you must follow the step-by-step opening procedure, the Plus500 sign-in link where you will be guided through a quite simple process of opening step by step. The demo account will be opened within 5 minutes, while to start Live trading you should submit necessary proves and documentation.

According to the particular jurisdiction of the Plus500 you will be asked to provide the documentation to prove your identity or some additional information. Once done, you will then be able to transfer money to your live account and start trading instantly.

Trading Fees

Plus500 applies a transparent fee structure with no surprises, all costs are essentially built into the competitive spread. Yet, apart from that, you should know about some additional fees like non-trading charges alike inactivity fee which we will see in detail further.

“Always note fees are always changing as Plus500 offering fixed and dynamic spreads. They are constantly adjusted to the market conditions, therefore here we provide spreads and rates for reference only that were actual at the time of the writing.” – Plus 500.

An overview of the Non Trading Fees

These fees should be taken into account while applying, even though Plus500’s non-trading fees are seen favorably. There are no withdrawal fees, while the minimum withdrawal amount is 100$, see the next paragraph in our Review, or other charges so the only case is Plus500 Inactivity fee.

Meaning, if your account is idle for three months and there are no trades made, the fee of up to $10 is charged. This takes place in order to secure service availability and adapted to real accounts only, which is easily avoided by the minimum activity even.

A quick look at Plus500

Of course, you shouldn’t decide anything regarding a broker or another just based on a spread charge, or select only the only with lowest fees. You need to consider all points of the trading offering together with other fees, trading conditions, regulations and so.

If we would quickly look at Plus500 offers, the first thing we would point is that they offer variable spreads along with an amazing variety of instruments. Yet, all asset classes offered only on CFD basis and the platform you may use is proprietary Plus500 software.

Spreads

Plus500 charges are built into the spread basis, as the majority of CFD fees that broker offers, also with no additional charges or commissions. Forex fees based on spread only with no commission, as this type of fees allows simplicity of the calculation and is the best suitable option for many traders despite the strategy. We will see Plus500 spread breakdown below, while foreign exchange fees are regarded as average.

An overview of the trading fees

In fact, Plus500 ranked fees through Plus500 Review as its spread appeared among the tightest spreads and average or actually competitive ones in the industry.

Since it is crucial to compare brokers and Plus500, it might be challenging to determine whether the costs are acceptable or not. For this reason, we will examine this further.

Deposits and Withdrawals

Plus500 subsidiaries are authorized and regulated in the jurisdictions in which they operate, therefore with its compliance with client money rules and high level of protection you may transfer funds to or from trading account conveniently.

Below we compare Plus500 to other CFD broker which offer both retail investor accounts and Professional account with a similar proposal and financial instruments.

Deposit fees and options

At this time, Plus500 continues to uphold a fantastic customer-focused policy, which makes funds transaction smooth process with free of charge deposits while none of the charges are passed to the client. However, if you made a deposit in a different currency to that which account is denominated in, the company may pass on commissions for conversion.

There is offers a great range of base currency as well, meaning if you allocate your account in particular currency there is no conversion fee paid for your bank account in case you make the transaction at a defined rate.

Several methods of transferring money to trading accounts are supported by Plus500, including

- Credit Debit card (only Visa or MasterCard debit/credit card are acceptable)

- E-wallets including PayPal or Skrill

- Bank transfer with the direct bank to bank funds transfer

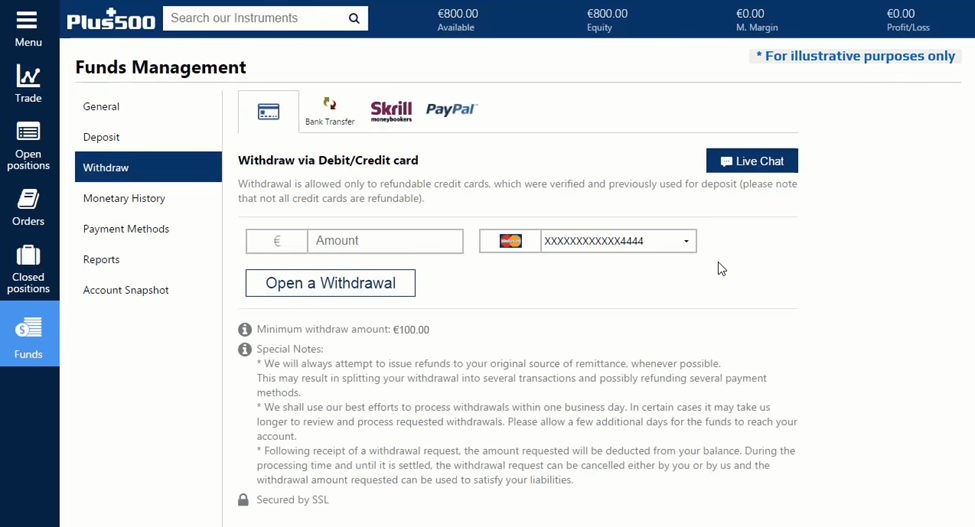

Plus500 withdrawal

Plus500 withdrawal fee is $0, yet you should set request to withdraw more than a set minimum amount of 100$ and up to five per month times. Withdrawal methods including Bank Wire Transfer, Credit Cards and electronic wallets have a minimum amount of thresholds, which can be found on the withdrawal screen on the trading platform and varies from one jurisdiction to another.

How long does withdrawing money from your account take?

Once you follow the steps and submit your withdrawal inquiry, Bank Transfer or other methods typically processed and confirmed by the Plus500 accounting team within 1-3 business days.

You should always give some days for your payment provider to process the transaction which depends on the jurisdiction and provider rules.

How to withdraw money from Plus500?

The following actions should be followed in order to withdraw money from your trading account.

- Login to your account select Withdraw Funds’ at the menu

- Enter the withdrawn amount

- Choose the withdrawal method

- Complete the withdrawal request along with necessary requirements

- Confirm withdrawal and Submit

Trading Platforms Plus500

Plus500 has a platform user interface that is clear, straightforward, and intuitive for CFDs that is a Plus500 proprietary trading platform that is also solely based online.

The difference between Plus500 WebTrader & Windows trader

There are several versions that are appropriate for any device and are typically updated by the Plus500 WebTrader platform is a desktop based platform via a web browser. This means you don’t have to download or install specific software onto a PC, you just need an internet connection. The WebTrader & Windows trader eventually is the same feature available through your browser at Plus500.

- Plus500 does not offer desktop platform Windows

Login and Security

You may therefore use your current Google or Facebook account to login with security settings to your account and get started.

Customer Service

Another excellent feature of Plus500 is its customer support team, which is available around-the-clock and provides email, live chat, and WhatsApp help. Therefore, since the support team’s service is good and professional, you should contact them with any questions or inquiries you may have.

Plus500 gladly assist traders in various ways and truly relevant answers, with reliable and quick guidelines or help you should request, which is fantastic and important for you as a client. Also considering a grate range of languages they support and availability 24/7 with live chat rewards them even more, as this level of support is quite rare among other brokers.

Education

As for the instructional resources required for new traders and alongside your trading path at all times, Plus500 does not provide these.

It provides a rather limited range of educational materials and no trading course in general or live webinars. There are some course videos known as Plus500 Trade’s Guide which is just a guide on how to use a proprietary trading platform.

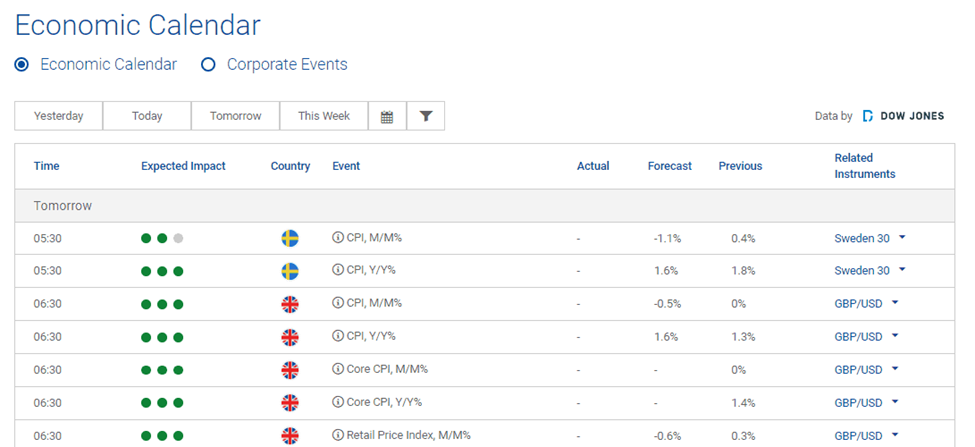

The platform itself offers great charting tools alongside with economic calendar, built in news feed and alert systems which are useful. But there is no provided technical analysis or other materials with research purposes to support your everyday trading.

Research

Research is also highly beneficial for learning and research purposes, as well as for improving your trading and keeping you informed of market conditions. However, there is no fundamental analysis or trading ideas also news are rather general, also with no social trading functions.

Therefore, trading with Plus500 you should perform your own research before making trading decisions, which is more suitable for experienced traders. If you are a complete newbie, it could be beneficial to look into other brokers or find a quality educational course to help you succeed in what you do.

Conclusion

Overall, Plus500 having operated over 10 years obtained a name of a trusted CFD broker with an extensive variety of instruments, provided by OTC operation. For the quality of service, we witness good ability to cover various trading demands, easy to use a simple trading environment, good apps with great spread offering and a balance between trading conditions. However, Plus500 working with CFDs model of operation only, while products usually leveraged with may involve high risk for real money.

Is Plus500 good for beginners?

Actually, the company’s one limitation is that there is no comprehensive educational support, as well as analyst recommendations or fundamental data, which is not so good for beginning traders suitable for retail investor accounts.

Plus500 platform is suitable for experienced traders only, though Plus500 is a very user-friendly platform, yet CFDs are complex financial products, thus the platform is not suitable for beginners or un-experienced traders.

However, this is not a particularly negative aspect because Plus500’s key characteristics and possible success circumstances are at a fairly sustainable level. Besides, always consider whether you can afford trading with real money as risks while trading includes a possibility that accounts lose money.

Vestibulum vehicula dapibus leo, ut fermentum dolor sollicitudin at. Sed euismod lobortis ipsum sit amet pharetra.

Donec lacinia erat in ullamcorper accumsan.

Fusce fringilla efficitur varius. Integer elit turpis, tristique non massa ac, vehicula viverra urna. Maecenas congue pulvinar mattis.