XM Group has a Trust Score of 90 out of 99, which is believed to be very excellent. XM Group is authorized by two tier-1 regulators (high trust), two tier-2 regulators (medium trust), and one tier-3 regulator, however it is not publicly traded and does not run a bank (low trust)

- Low stock CFD and withdrawal fees

- Easy and fast account opening

- Quick and helpful customer support

- Great educational tools

- Well regulated globally

- Limited product portfolio

- Average forex and stock index CFD fees

- Mediocre research tools

- Lacking partners support

Why to choose XM?

Here is why to choose XM or simply skip it, up to you to choose!

With a support staff that speaks 30 different languages and clients from over 196 different countries, the XM broker, which began operating in 2009, is one of the most reputable Regulated Brokers.. The main branch located in Cyprus regulated by CySEC, yet offices are truly cover global needs and serve through Australia, UK, Belize, Greece also authorized in Dubai and MENA region.

There are about 1.5 Million Traders and investors at XM that selected broker proposal and services, there are many advanced trading solutions, yet suitable for beginning traders. Therefore, it is safe to say that XM is a reputable broker with favorable trading conditions XM aims to provide one of the best user experiences in the industry to its clients.

Generally, all procedures from account opening, managing, depositing/ withdrawing, and trading is basic and straightforward, which we will see in detail further within XM review.

We include XM’s large variety of trading instruments, extensive regulations, and outstanding reputation as some of its significant benefits. Besides, the offering is user-friendly and XM has one of the lowest deposit requirements among the industry, CFD costs we found average and platforms are very friendly to all types of traders.

With its global approach and discovery of new markets, XM also supports webinars and research materials, allowing traders to interact and begin their trading careers. At XM, accounts can be started regardless of net capital with as little as $5 or prior trading experience.

On the other hand, as we noticed XM has limited portfolio for EU clients, and outside EU clients there is no good investor protection.

However, XM does not provide a very broad selection of trading for European clients, mainly all are offered on CFD basis, while the range is larger for international traders along with various trading offerings too. Also, Spreads are within the average, some Brokers may have slightly lower spreads based on what we discovered.

Awards

XM successfully achieved a strong focus on the client’s needs while providing competitive conditions and a variety of services that draw international traders. Over time, we have witnessed both the company’s growth and its awards, which have gone from being given occasionally to now being given on a regular basis. Aside from its excellent performance and standing in the trading industry, XM received truly global recognition with many reputable awards for industry achievements including Best Forex Broker for Europe, Most Trusted Broker, etc.

Is XM safe or a scam?

XM is not a scam, no. We view XM as a reliable broker. Forex and CFDs, since XM is regulated and licensed by several top-tier financial authorities including FCA, ASIC, CySEC. Therefore, it is secure and low-risk to trade.

Is XM Broker regulated?

XM Group is a group of regulated online brokers, which serves as Trading Point of Financial Instruments Ltd established in 2009 and regulated by the Cyprus Securities and Exchange Commission (CySEC). Another entity Trading Point of Financial Instruments was established in 2015 in Australia and is regulated by Australian Securities and Investments Commission (ASIC) (Also like FP Markets). Read more, why trade with Australian Brokers by the link so the regulatory obligations are covered at a sustainable level as we see through our XM Review.

But the thing to remember is that – global operation enabled by XM Global Limited established in 2017 is regulated by the Financial Services Commission, allowing to offer its services across the globe. Despite the fact that IFSC is an offshore license, that does not actually implement strict overseeing of the trading processes, yet additional heavy regulation of the XM making it an acceptable choice.

Is XM a reliable broker?

The regulation’s major goal is to make trading secure for traders by ensuring that client funds are handled with the strictest regulations and with the lowest possible risk of fraud or unfair use. XM operates its trading environment according to the regulatory measures making it a reliable broker.

As well as, Client funds are kept in investment grade banks and use segregated accounts, falling under the Investor Compensation Fund that ensures recovery of funds up to €20,000 in case the broker goes insolvent (note that the coverage scheme depends on the particular entity). Negative Balance Protection is another benefit you’ll receive as a trader, so there’s no chance of losing more than your available balance.

Leverage

You can utilize leverage on a range of scales from 1:1 to 888:1, depending on the account type and the entity under which the XM complies with regulatory requirements. So, to understand which leverage level you are entitled to use, always refer to the conditions of your residency as various XM entities apply different conditions again due to regulatory obligations, also note, Leverage depends on the financial instrument traded:

XM offers leverage up to 30:1. This Leverage applies to the EU-regulated entity, European clients of Trading Point Cyprus may express a ratio of 1:5 for Cryptocurrencies and even a maximum of 1:2 for some products.

XM Australian entity and its regulation allows up to 500:1

And International entity offers high leverage of 888:1

Although you can learn more through the XM education center, see the snapshot for EU clients below, it is always advisable to choose your leverage wisely as well as the entity under which you would like to trade.

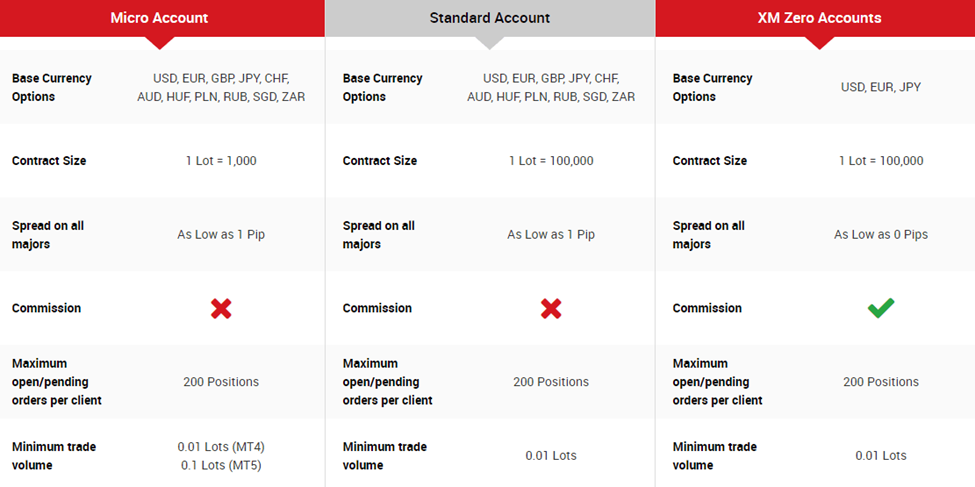

Account Types

By providing a variety of account types, XM has simplified things so that you can use either account to trade smaller lots according to your desired trading style via Micro Lots, or to trade regular size with Standard account based on spread only basis. Lastly, Zero Accounts will offer you another fee strategy where the spread is an interbank quote starting from 0 pips and the trading charge will be deducted through a commission per lot, see our snapshot below.

Can you open XM account in South Africa?

If you are a trader from South Africa – yes you can open XM account, as XM applied for registration to local regulator since 2016 and even since appealing to South African traders. So truly worldwide traders can enjoy great customer-oriented features XM offers and engage in all the trading benefits relatively easily.

XM Account Base currencies

As for the account base currencies, by choosing XM Account you you can choose the base currency of your choice from the wide range provided. This range includes even the South African Rand (ZAR) or Singapore Dollar (SGD), besides to other global currencies. All in all registering with XM allows you transparency of money transactions, while you will avoid conversion fees for both deposits and withdrawals while selecting your preferred base rate.

Trading Instruments

XM provides a wide range of products so you can have a fantastic selection that satisfies your needs and preferences. In addition, we observe a sharp increase in the instrument offering in comparison to prior years. adding more Cryptocurrencies and CFDs to the list.

A range of trading markets is available from a single multi-asset account that offers 6 Asses Classes and includes about 55 currency pairs with a total over 1000+ trading markets. And so you are able to trade Forex or CFDs on stock indices, commodities, stocks, metals, energies and Cryptocurrencies at XM all available from the same trading account.

Is XM a stock broker?

Although XM offers a good selection of stocks for trading, including both well-known and minor stocks, these stocks are primarily based on CFDs, so you are not trading or investing in real stocks. Additionally, according to the research we conducted, conditions and offerings are different.

XM Markets Range Score is 8 out 0f 10 for good trading instrument selection, yet the only gap that European entity offers mainly CFDs and Forex Instruments, and much wider range is only available for International Clients

Fees

XM operates with variable spreads, just like the interbank forex market and imposes no restrictions on trading during news releases. XM fixed spreads are higher than variable ones, as well are more flexible to different trading strategies. That means all trading costs are calculated into a spread with no hidden fees and tightest spread offering.

Additionally, it is advised to examine some expenses below based on our findings when choosing a broker so that you can see the complete picture. These prices include non-trading fees, withdrawal fees, and other applicable fees.

XM Fees are ranked average, low with overall rating 8 out of 10 based on our testing and compared to over 500 other brokers. Fees might be different based on entity, also majority of currency pairs are on an average level for spreads, additional fees like funding fees, rollover.

Spreads

XM pricing and costs are based on a spread, in case you open Micro or Standard account. Also, XM spread is a fractional pip price that gets the best prices from XM’s various liquidity providers. Meaning, instead of regular 4-digit quoting prices you can benefit from the smallest price movements by adding a 5th digit, known as a fraction.

Below you may see average spread reference calculated throughout the day on a Standard account presented for most popular products. Even though some spreads might be higher than its industry competitors, the overall fee structure is rather average for Forex products and low cost for CFDs.

XM Spreads are ranked average/ low with overall rating 8 out of 10 based on our testing comparison to other brokers. We found Forex spread closer to the industry average of 1.2 pips for EURUSD, while other accounts based on commission might be good choice for professional traders.

What is XM commission?

The commission fee is added on XM Zero Accounts only, as you will be trading with interbank spread quotes starting from 0 pips and commission charge as a trading fee. XM applies transparent conditions and a quite competitive offering of $3.5 per lot per 100,000 USD traded. Also, you may use the fee calculator provided by the XM for an easy understanding of your costs.

Overnight fee

Finally, it is necessary to calculate XM overnight fee or the fee that a trader pays in case the position is opened longer than a day and is agreed through a swap contract that comes as a cost. Every currency has a different interest rate which comes as a calculation.

Assume, for instance, if interest rates in Japan and the US are 0.25% p.a. and 2.5% p.a. respectively, with an open position, you can either gain USD 6.16 per day or lose USD 6.16 per day, as the rollover calculated as an interest to borrowed currency or earned on the purchased currency.

You may see also swap fee conditions on the snapshot above, as well for better information check out and compare XM fees with another broker.

Deposits and Withdrawals

Customers are prioritized in the processing of fund transactions at XM, and traders have access to a variety of payment options that are accepted internationally. Various payment options including commonly used, also XM introduced a local bank transfer option, which is definitely a plus for many countries since enables to fund the account through local banks and currency with no conversion charges.

XM Funding Methods we ranked Excellent with overall rating 10 out of 10.

Minimum deposit is among lowest in industry, also Fees are either none or very small, besides range of supported funding methods is good, yet based on the entity you trade with.

Deposit Options

XM supports many Deposit Options, see below snapshot from our account opening.

Credit cards, Bank wire and Local Bank Transfer (available in some regions),E-wallets including Neteller, Moneybookers Skrill, Western Union, etc…

XM minimum deposit

XM Minimum Deposit amount is 5$ only for Micro Account or a Standard Account, in case you wish to trade with Zero account minimum deposit is competitive also, demanding 100$ as a start. The sum, however, changes based on the selected payment method and the status of the trading account validation. However, the Members Area contains all the information you need to read.

XM Withdrawal

XM withdrawal options are the same as the deposit ones, including Bank Wire transfers, e-wallets and Credit Debit cards. XM applied 0% Withdrawal Fee and offers zero fees on both deposits & withdrawals. Definitely a wonderful addition is that the XM company got all the transfer fees covered including e-wallets, major credit cards, instant account funding, and wire transfers with no hidden fees or commissions.

Furthermore, while the majority of brokers still charge for wire withdrawals, XM deposits and withdrawals above 200 USD processed by wire transfer are also included in the Company’s zero fees policy.

How do I withdraw from XM Account?

To withdraw funds from the XM trading account simply follow the on-screen instructions. It’s also a good idea to get in touch with customer care if you have any queries or concerns because they were helpful to us.

How long does XM Withdrawal take?

While the XM Accounting team processes withdrawal requests quite quickly within 1-3 business days it depends on the country the money is sent to, as various rules and policies apply. The standard bank within the EU will take around 3 working days for the money to be available on your account, yet some methods or institutions may process almost instantly or take longer, all depending on the payment method you use.

XM Trading Platforms

In terms of trading software, XM gives clients access to make transactions and trades throughout well-known and perfectly-developed trading platforms MetaTrader4 and MetaTrader5 and its own one too.

Platform Ratings

XM mainstay on the most popular industry platforms MT4 and MT5, obviously to the benefit of traders, as the platforms are well-known and enable you to obtain a variety of extensions or receive in-depth training on tool usage. Therefore, the platforms receiving good evaluations as a result of their global awareness are always positive for brokers’ proposals.

XM Platform are ranked Excellent with overall rating 10 out of 10 compared to over 500 other brokers. We mark it as excellent since XM offers choice between industry popular platforms like MT4 and MT5, also developed its own platform with good research, excellent tools, copy trading, Robot Trading, EAs and quality execution.

Web Trading

Directly accessible just from one account and available in various versions all platforms are integrated with a full site of technical analysis, indicators and comprehensive tools, stop or trailing orders. You may access XM trading just by the use of the browser and login to Web Trading, see below our recommendation and evaluation of Pros and Cons on XM Web Platform.

Desktop Trading Platform

Though XM made the software even more advanced and suitable through 16 Trading platforms, which are suitable for every device including web, mobile, and even multiple accounts trading. You get full account functionality and make the trading process at ease and comfort if you select the Desktop platform or other versions to trade.

Since XM uses MT4 or its newer version MT5 you are able to use its powerful capabilities along with automated trading or trading robots. EAs available with unlimited use of charts for those that prefer technological trading, also great manual trading tools will assist in your strategy as well. Overall, all needs and requirements for trading are met, they are at a very sustainable level, and they may be a suitable match for different type of traders..

Look and Feel

Known for its clear and pleasant trading experience, MetaTrader also has some of the most effective charting tools available. You will therefore appreciate its appearance and available features just like we do.

Mobile Trading Platform

Of course, you can also trade using a mobile device. XM MT4 Android and iOS apps, along with XM MT5 apps will give you access to a trading account with full account functionality. MT4 and MT5 apps also offer great charting with 3 Chart Types, over 30 technical indicators in its package, and a full trading history journal.

XM Customer Support

Regarding customer service and support, it is clear that XM caters to all trading requirements globally, and the customer care team is available in foreign countries and speaks more than 25 languages, including Chinese, Russian, Hindi, Arabic, Portuguese, Thai, Tagalog, and others.

You can contact the customer service team every day of the year. The broker can be reached by phone, live chat, or email. We also discovered that the service is of high quality and provides accurate responses, which further validates The client-focused approach of XM.

Customer Support in XM is ranked Good with overall rating 8 out of 10 based on our testing. Support is knowledgeable, fast answers are received on Live Chat, also quite easy to reach during the working days.

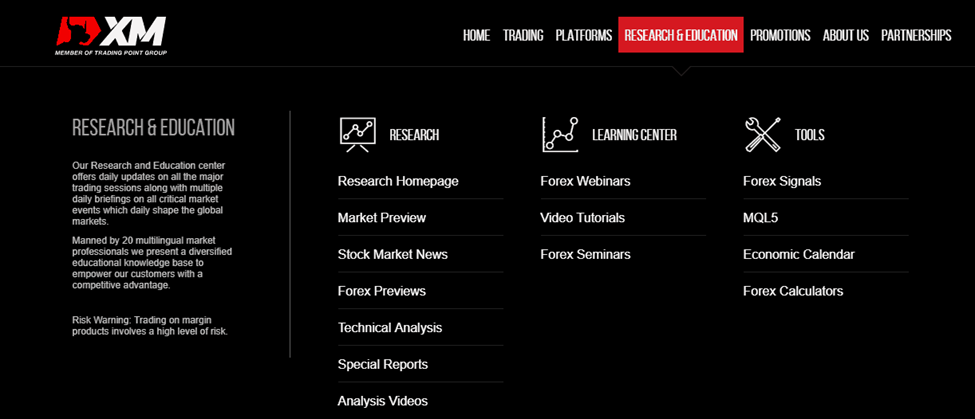

Education

Every client has access to a wealth of educational resources through the XM Learning Center, full of trading data and other essential information that raises trading to a higher level, in addition to receiving excellent customer support. In this aspect, XM went above and beyond and created genuinely extensive education support across numerous locations with the intention of educating traders, which is fantastic for all traders.

With XM you may count on quality learning, as we found based on our tests, defined also by your level, which includes Live Education offerings, Educational Videos, Forex Webinars, and regularly held Forex Seminars in various destinations. In addition, there are very well-organized tutorials, videos and tools at your disposal.

XM Education ranked with overall rating 10 out of 10 based on our research. XM provides great Education Materials, quality research and runs its Academy with Webinars, Excellent Trading videos and more.

Conclusion

In conclusion XM Review is a well-regulated broker with numerous highly respected licenses that delivers truly transparent conditions and is an extremely customer-friendly broker. No re-requotes and no hidden fees or commissions policy, as well Negative balance protection definitely a plus. Overall, we had excellent real-time market execution and a very comfortable trading experience, making XM quite popular among trading platforms and ideal for all levels of traders, including newbies.

Based on Our findings and Financial Expert Opinion XM is Good for:

Beginning Traders

Traders who prefer MT4 and MT5 platform

Currency Trading and CFD Trading

Suitable for a Variety of Trading Strategies

So overall we conclude XM has one of the most Comfortable proposals in terms of costs, trading conditions and opportunities overall before broker has much lower trading instruments in its range, however, given the variety of options available, it is now one of the strongest points.