Martynas Bieliauskas, Klarpay CEO tells us how Klarpay’s Payment Innovations Empower Digital Businesses Worldwide

Can you share the story behind Klarpay’s inception?

What inspired you to create a digital bank that focuses on providing cross-border payment solutions to global businesses?

Klarpay’s business case grew out of our personal frustrations with the traditional banking system and the many challenges and inefficiencies we’ve faced when dealing with cross-border payments in our past business ventures. As digital entrepreneurs ourselves, we had to deal with multiple financial institutions that had a hard time understanding and evaluating our business cases. Meanwhile, the increasing compliance requirements from regulators meant that accessing business banking solutions by traditional financial institutions was even more challenging as they had difficulty classifying the risks related to innovative online models. What we soon came to realise was that there was a need for progressive banking solutions that could cater to the needs of digital businesses, which typically operate across borders.

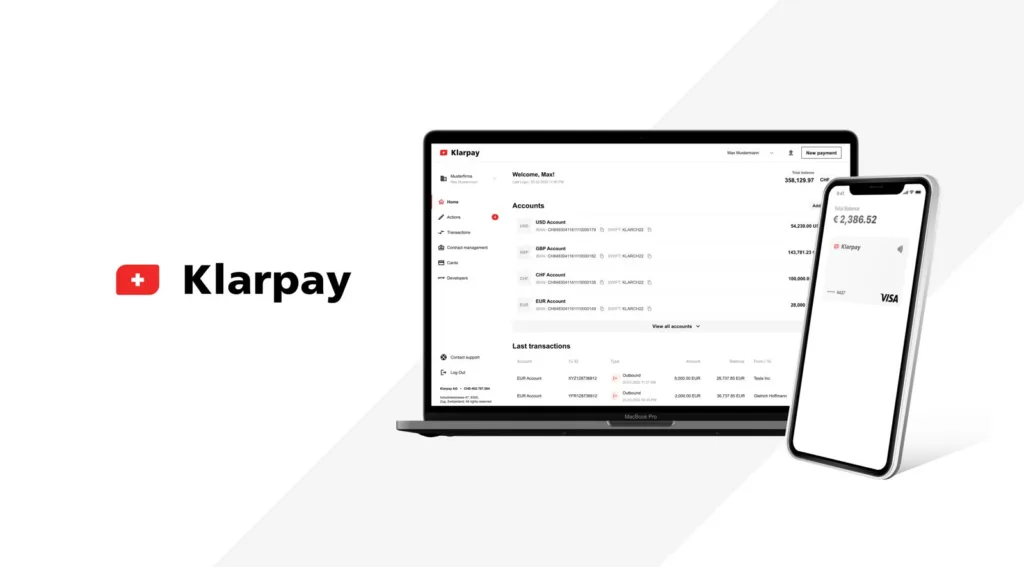

With Klarpay, we sought out to create a simple, transparent, and efficient all-in-one banking solution that includes Swiss IBAN multicurrency accounts, global payment acceptance and disbursement solutions in more than 100+ countries and 80+ currencies, card-issuance solutions, state-of-the-art encryption, authentication, fraud prevention technologies, API integration and some of the most competitive exchange rates.

Most importantly, we understand the vision and needs of digital businesses and support them to grow and succeed in the global market.

Switzerland has a renowned reputation for its financial services industry.

How does being based in Switzerland contribute to Klarpay’s ability to offer cutting-edge banking solutions to its clients worldwide?

The Swiss fintech and banking sector is undeniably renowned for its reliability and expertise. Switzerland has a transparent, stable, and business-friendly legal system, as well as a progressive and digital-friendly supervisory authority.

In 2020, Klarpay AG was regulated under the Swiss Banking Act as a deposit-taking institution 1b. This enables us to offer cutting-edge business account banking solutions that comply with the highest standards of regulatory and legal requirements.

Looking ahead, what is Klarpay’s vision for the future?

Are there any upcoming developments or projects that you would like to share with our readers?

At Klarpay, we are always innovating to provide global corporates with simple, transparent, and convenient access to move value globally. We have a range of products tailored to their specific needs, and we are constantly adding additional currency corridors and enhancing our API capabilities.

Our most recent launch is USD-denominated Visa Cards. These cards allow our clients to issue and use USD-denominated VISA debit cards linked to their USD accounts with Klarpay. This way, they can eliminate Forex Exchange costs when spending with popular U.S.-based companies like Google, Facebook, or Amazon Web Services.

We also plan to roll out Deposit Guaranteed Accounts for select currencies guaranteed by one of the largest banking groups in Switzerland. These guarantees will be in excess of the typical deposit protection scheme offered by Banks in Switzerland. Our solution aims to build confidence for our corporate account holders, who often hold larger balances.

Last but not least, we plan to launch Klarpay’s private accounts to individuals in addition to Klarpay’s corporate banking offer. We intend to use this for our embedded banking solutions for marketplaces as well as limited transactional capabilities to Founders of businesses that already hold accounts with us.

In a highly competitive fintech market, what sets Klarpay apart from its competitors, and how do you plan to maintain a competitive edge moving forward?

Some of the unique value propositions that Klarpay currently offers digital entrepreneurs include:

- Our strong regulatory environment and wide range of services. We provide comprehensive corporate accounts and payments services, including IBAN and virtual debit card issuance, global payment acceptance, and disbursement solutions.

- Our experienced team consists of serial entrepreneurs, tech experts, and Swiss banking professionals. We have the vision, expertise, and passion for creating innovative and reliable solutions for digital businesses of all kinds.

- Our proprietary technology systems are developed in-house. We offer a fully digital onboarding experience and global payment capability (in more than 80 currencies) through a modern user interface and APIs. Our API integration enables companies to process single and bulk payments automatically with enterprise-grade security.

To maintain our competitive edge in the future, we are committed to continuing to innovate and adapt to the changing market conditions and our client’s expectations. This entails investing in research and development, experimenting with new ideas and products, and collaborating with other players in the fintech ecosystem. We also plan to remain agile and flexible in responding to regulatory changes and emerging opportunities.