Forex trading is not an easy skill to master but you can shortcut your learning curve by implementing the right tips and tricks which I’ll share with you.

Appreciation and leveraging of core Forex insights will help you craft actionable trading wisdom

Supply and demand are the two main modes of the forex market. For example, Japanese citizens are eager to exchange their Yen for the US dollar. Many nations in the world have currencies similar to this example.

It is common for the US dollar’s value to appreciate while the Yen’s value depreciates during a forex transaction. Currency pairs such as USD/JPY exhibit this behavior but not individual currencies. When USD/JPY is exchanged, the US dollar will not appreciate against the Euro (forex trade).

Thousands of currency exchanges operate every day from Monday through Friday. Several entities and individuals are involved in these forex transactions, including retail investors, banks, hedge funds, private equity investors, and hedge funds. The foreign exchange market is driven by many factors, including these forex currency exchanges.

Forex markets are also affected by the following factors:

- Unemployment Rates:

An economy’s unemployment rate reveals its health. An increase in unemployment indicates a weakening economy. It depreciates the nation’s currency, making it more attractive to sell. A stronger economy and its currency appreciation are characterized by lower unemployment rates than expected (producing a buying opportunity).

- GDP (Gross Domestic Product)

By looking at a country’s GDP, traders can quickly gauge its economic situation. The US dollar appreciates versus the Japanese yen when countries with a higher GDP have a stronger currency. The US dollar will depreciate against the Yen if the US economy reflects a weaker GDP, preventing interest rate hikes.

- Inflation

It is interconnected between supply and demand, determining a nation’s currency value and inflation. A country with a low-interest rate typically has a weaker currency than others. High-interest rates result from an economy that is more robust currency.

- Interest Rates

A nation’s currency often appreciates in countries with higher interest rates. Changing interest rates can curb or stimulate the economy, so interest rates are closely linked to inflation. It enables the nation’s economy and increases its value against other national currencies when a nation’s currency appreciates.

- Global Affairs

Elections, natural disasters, and war can significantly impact the foreign exchange market. Post-war war can stimulate economies when the nation’s currency must be devalued by cheaply financed capital at minimal interest rates. Economic output can be crippled by war or natural disasters, while consumer confidence can be affected by elections.

Forex Market Currencies

Banks, hedge funds, commercial companies, central banks, and retail investors fuel the liquidity of the foreign exchange market. A decentralized market, without oversight, allows participants to exchange, speculate, buy, and sell currencies.

Forex is the largest financial market, with a daily trading volume of over $6 trillion. This is more than 25 times the daily volume of all the world’s stock markets combined (~$200 billion/day). Investing in forex offers investors high liquidity and low spreads due to the market’s enormous size.

Here’s how the foreign exchange market is divided by currencies.

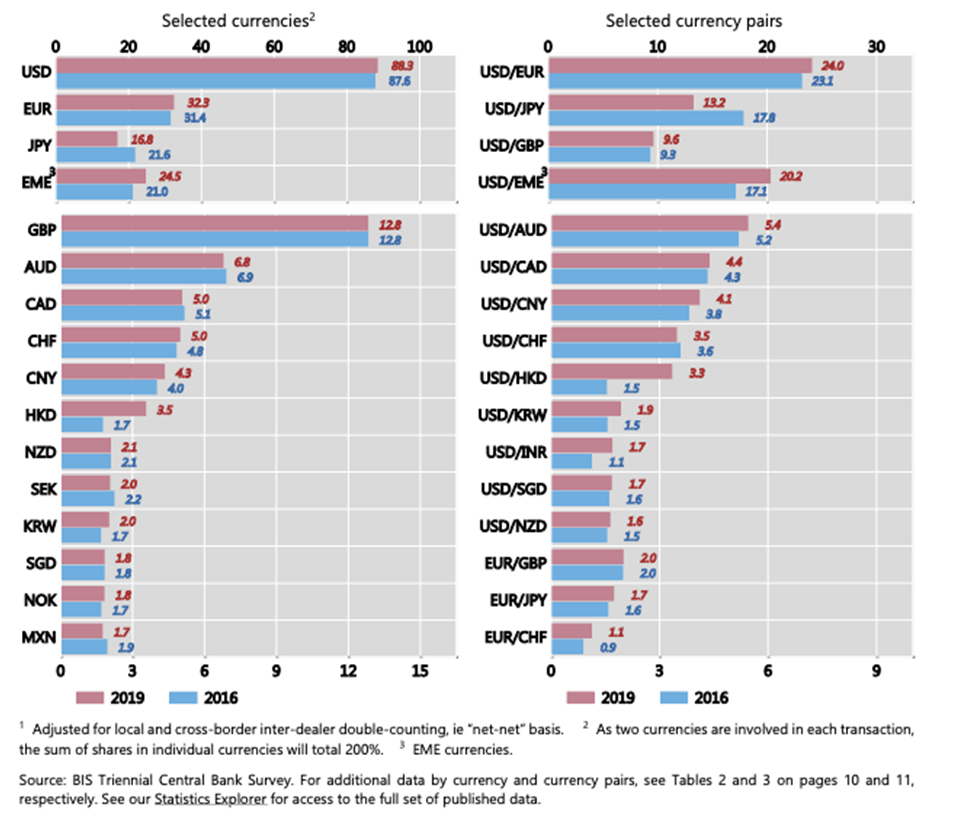

The US dollar dominates world trade. Most forex transactions involved the US dollar, which accounted for over 88% of all trades. EME rose nearly 4% points, while the Euro edged up and the Yen stagnated.

Among the ten most frequently traded currency pairs include:

Foreign exchange markets are large and complex, making them challenging for new investors to understand. Forex markets generate a daily trade value of over $6.6 trillion, which is the face value of the forex market. The forex market is more than 25 times the size of all the world’s stock markets combined ($200 billion/day), and as we know, size matters. In today’s publication, you’ll learn important forex market facts and learn what you need to know about forex trading, having an improved understanding of the market’s scope and size. With today’s takeaways, you can build a trading arsenal based on the core insights, so without further ado, here’s what you need to know:

- USD/EUR (24.0%)

- USD/JPY (13.2%)

- USD/GBP (9.6%)

- USD/EME (20.2%)

- USD/AUD (5.4%)

- USD/CAD (4.4%)

- USD/CNY (4.1%)

- USD/CHF (3.5%)

- USD/HKD (3.3%)

- USD/KRW (1.9%)

The US dollar is also paired among the top ten most frequently traded forex currency pairs. Do you know why the US dollar is traded more than other currencies? Only the United States had an economically strong currency following World War II under the Bretton Woods System (1944-71). The US dollar became the world’s reserve currency despite proposals for a global reserve currency called bancor.

The US dollar remains the world’s primary reserve currency as a safe haven currency. It is evident from the above chart that EUR/USD contributes over 24% to the forex market volume. To generate the world’s second-largest GDP, countries in the Eurozone consolidate their national currencies into the Euro.

Forex is also dominated by the USD/JPY pair. Over 13% of the forex market’s trade volume is composed of the USD.JPY despite Japan’s small GDP. Japan’s largest trading partners are the European Union and the United States.

Forex Market Trading Hours

Sunday through Friday, 5 pm EST, is the best time to trade on the foreign exchange market. There are a few overlapping market hours from regional trading hours on the foreign exchange market, open five days a week, 24 hours a day. Time zones are divided into four regions:

London (3am – 12 pm EST)

Historically, London has been a primary trade center because of its strategic location. More than 40% of all forex transactions originate from London during the London market hours. As London’s trading session overlaps with those in New York and Tokyo, liquidity is increased, pip spreads are lowered, and volatility is increased. Euro/Dollar, Dollar/Japanese, and Pound/Dollar are the most commonly traded currency pairs.

New York ( 8 am – 5 pm EST)

During the London and New York market session’s overlapping closing hours, the New York trading session is highly volatile. Liquidity and volatility of the markets tend to ease after London markets close. Any news relating to the US dollar can significantly impact its value since it makes up almost nine out of ten currency trades. Forex traders often trade currency pairs such as EUR/USD, USD/CHF, USD/JPY, EUR/JPY, and GBP/USD.

Sydney (5 pm – 2 am EST)

Domestic currency traders are in high demand for the Australian dollar (AUD), which accounts for almost 7% of daily forex volume. The three most frequently traded currency pairs are USD/AUD, AUD/JPY, and AUD/USD. Due to its strong correlation with gold, hedgers who invest in commodities often invest in the AUD.

Tokyo ( 7pm – 4am EST)

Since the US and Euro markets are closed at those hours, the Tokyo trading session is the least volatile, characterized by low liquidity and volatility. As well as critical support and resistance levels, there are straightforward entry and exit rates and plenty of breakout trade opportunities. EUR/USD, EUR/GBP, and GBP/USD are among the most popular currency pairs traded during the Tokyo session.

Leveraging the FX Market

In terms of size and scope, the forex market dwarfs every other financial market globally. Understanding the WHY behind particular market movements and how they are driven will help you position yourself for optimal success.

With central banks, international businesses, and worldwide trade all in need of currency, the forex market can meet market demand 24 hours a day. Every hour, thousands of domestic and international currency exchanges take place.

For maximum trading potential, traders should also understand forex trading basics, such as fundamental and technical analysis, money management, and historical and fundamental knowledge.