Maintaining Order. Trade rules and automated transaction execution maintain discipline in turbulent markets.

Institutions prefer non-deliverable forwards.

Bitcoin rebounds from 2022.

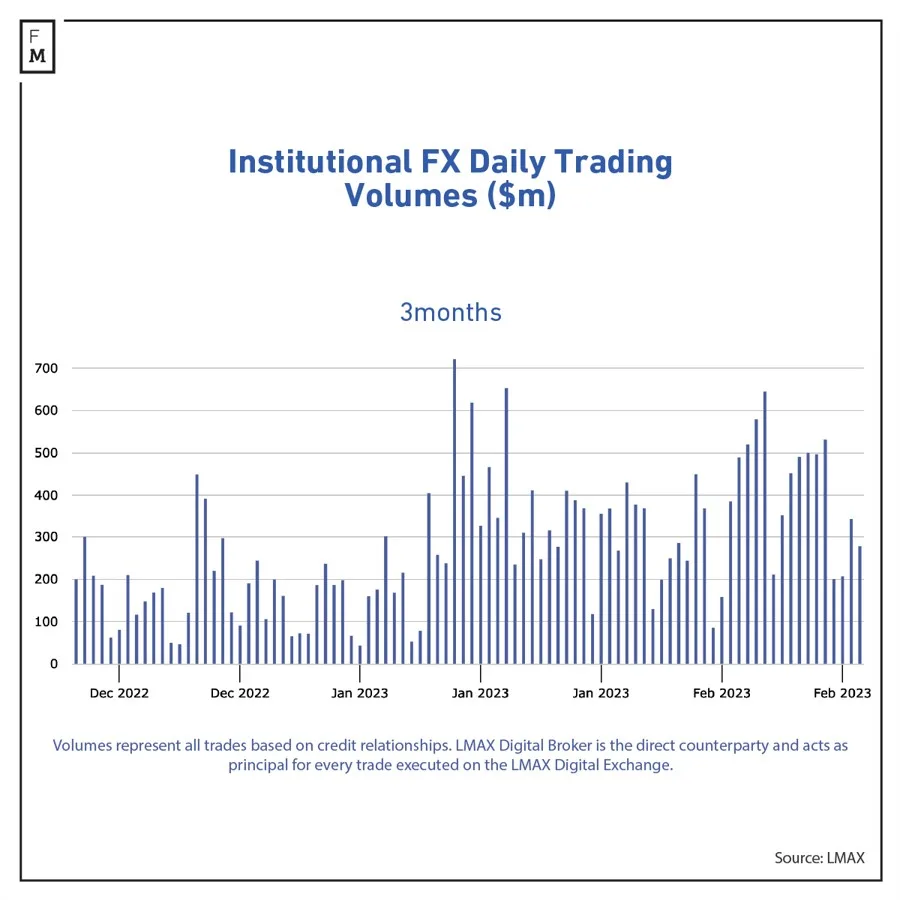

Early trade data suggests institutional FX platforms begun this year stronger than they finished in 2022. Cboe’s institutional spot FX platform had a 17% rise in trading volume in January compared to the previous month, while Euronext’s trading volumes rose 9.5%. At FXSpotStream and 360T, monthly average daily volumes rose 5.2% and 13.9%, respectively.

This rise is partly due to decreased trading activity in December due to the Christmas and new year vacations, but it also reflects positive signs like better global economic statistics and ongoing market volatility due to interest rate policy.

Algorithmic trading is the biggest trend in institutional FX trading, according to market participants.

“Over the past couple of years, and largely as a result of the coronavirus pandemic, uptake of FX algos has increased dramatically with clients and dealers looking to offset risk, access fragmented liquidity, and improve operational risk when working from home,” said BidFX Chief Revenue Officer John McGrath.

Continue Reading

- Altruist Announces Self-Clearing Brokerage to Revolutionize RIA

- Custodian Services 2023 Payments Fintech Innovation

FX trading’s commoditization makes algos easy to implement, accelerating expansion.

McGrath projected that FX algo trading accounts for 20% of daily spot activity and will grow as buy-side businesses get more comfortable and realize its benefits.

“Volatility and algos go together,” he said. “The return of volatility in the FX markets last year—driven by unanticipated fiscal measures from the UK government—has meant that algos will adapt once again to become even more sophisticated.”

Volatility impacts institutional customers who in 2022 prioritized regulatory changes and operational improvements but today prefer liquidity and data management.

McGrath thinks the inflation hangover affects institutional FX trades even after the outbreak.

“Central banks began rising interest rates in 2022 to relieve inflationary pressures, and it is probable that this will continue as several are forecast to hike rates to their highest level in 15 years,” he added. “FX traders will have to change their approach this year as risk variables that haven’t been relevant for a while return.”

During the past decade, low interest rates have hampered interest rate or growth differential carry trades. Volatility gives institutional FX traders a lifeline.

Institutional asset managers are increasingly interested in bilateral clearing of non-deliverable forwards (NDFs) to decrease their uncleared margin requirements, McGrath said.

“FX is a by-product for the real money asset management community,” he remarked. Most money managers manage currency risk rather than trading for alpha.

An LMAX Group representative said artificial intelligence and machine learning had driven algorithmic trading. In the early weeks of 2023, favorable risk sentiment in traditional markets has helped cryptocurrencies, which more institutions perceive as a logical extension to FX trading, increase volumes.

LMAX Group trade data shows that daily trading volumes spiked in the second week of January after a calm spell from the middle of November.

Jamie Trickett, Global Head of GlobalLink’s FX trading platform product, believes voice interactions will remain crucial despite the expansion of data-driven technological solutions used to construct automated trading models and that institutional FX trading desks are becoming a blend of skillsets.

“Traders are continually searching for advancements in the speed and efficiency of completing transactions as well as better and quicker access to liquidity,” he added.

Institutions spend extensively on technology to boost trading and data analysis. While market trends require heads of desks to examine how they manage employees and technology to ensure they are efficient across all asset classes, the buy-side is also trying to simplify how its systems communicate.

Trickett said smart trading systems with improved interoperability will boost efficiency and simplify FX trading procedures. “Independent and unbiased data helps institutions make better trading decisions.”

Electronic trading increases customers’ data, but they still need to transform it into useful measures to improve their trading results. This raised demand for real-time pre- and post-trade data to improve FX trading transparency and execution.

Institutional FX traders are moving toward NDFs, options swaps, algo trading, and electronic trading, Trickett said. “Automated trading volumes have increased 40% year-on-year,” he concluded.